AI is most commonly being used in finance roles (63%) despite awareness of potential risks, according to new research examining consumer and business attitudes in the financial sector across Europe.

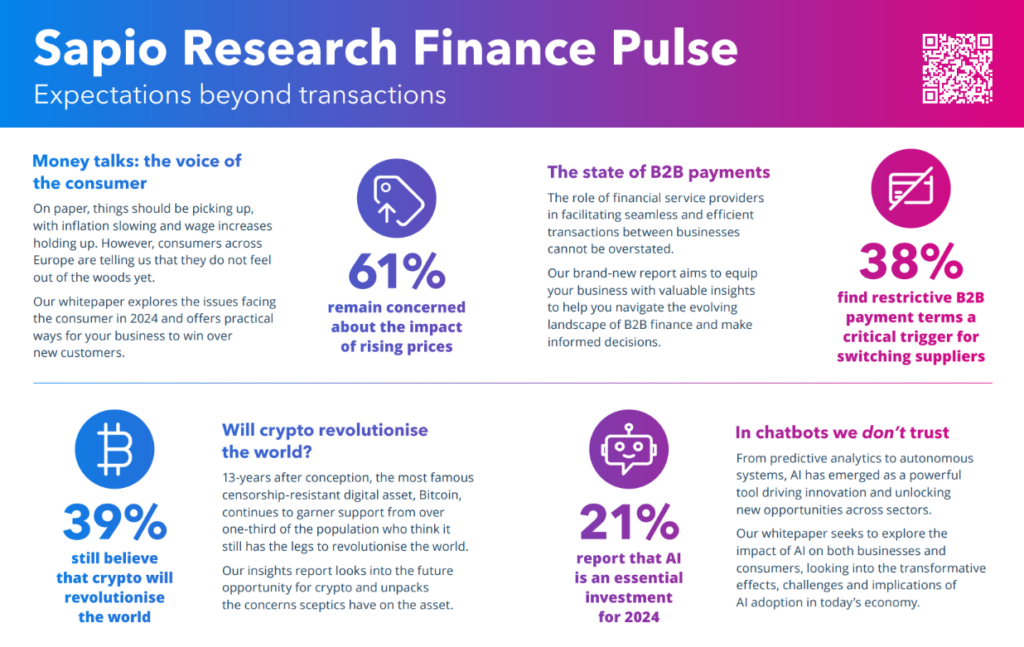

The Sapio Research Finance Pulse 2024 report explored the impact of AI on businesses and consumers, consumer financial sentiment and the evolution of B2B payments. The report comprised of three sections; Money talks: voice of the consumer, The rise of AI and The state of B2B payments.

Sapio Research surveyed 800 consumers and 375 senior business decision makers with authority in their B2B finance department, across the UK, Germany, France and the Netherlands.

The results revealed that generative AI was most commonly used in finance roles (63%), with marketing (27%) and sales (19%) being amongst the lowest users.

Across the board, there was majority consensus that businesses will invest in AI within the next 24 months, particularly in France (75%), Germany (82%) and the Netherlands (76%).

With 21% of businesses overall reporting AI as a top investment priority, it’s unsurprising that 93% were also aware of the risks associated with using AI. Data security was the most commonly perceived threat (43%), followed by intellectual property and legal risks (41%) and lack of accountability or transparency (29%).

Despite a keen awareness of risks, half of businesses surveyed had no strict access to limitations in place (62%) and no guidance on acceptable use of AI (54%), highlighting a significant need for proper guidance and support.

In terms of consumer attitudes to AI, Sapio Research’s report found that aside from when solving simple problems, consumers don’t appear comfortable using AI chatbots. The survey found that only 15% of people would be happy to take financial advice from an AI chatbot, despite 50% of senior financial decision makers having the opinion that generative AI has the highest potential in the front-end of their business. Therefore, care must be taken when deploying AI and personalisation is key to win the trust of customers.

Sapio Research’s 2024 Voice of the Consumer Survey

The report also explored consumer attitudes towards financial services across the UK, Germany, France and the Netherlands, looking at areas such as digital banking adoption and financial fears.

It revealed that three fifths (61%) of consumers are concerned about the impact of rising prices on their day-to-day spending items. Financial optimism was higher for younger consumers. 58% of 25–34-year-olds believing their financial situation will improve in 2024, compared to just 13% of 55–64-year-olds.

Younger consumers also appear to be more open to new and emerging financial products. 64% of 25–34-year-olds believe crypto will ‘revolutionise the world’, and this demographic was also revealed to have the highest digital banking adoption. However, crypto is far from ready for mass adoption, with the general population still having concerns about its use. These include the possibility of crypto being used for fraud (55%), money laundering (51%), and social-engineering scams (36%) as well as environmental concerns (39%).

Sapio Research’s 2024 State of B2B payments survey

In addition to looking at consumer attitudes and AI, Sapio also gathered insights from 375 senior business decision makers, with authority in their B2B finance department, about their use of B2B payments.

Interestingly, 60% of businesses agreed that the B2B payments sector is developmentally behind the B2C space. The survey reported that only half (48%) of B2B businesses have shifted to exclusively use digital payment methods, whilst the B2C payments sector has witnessed significant digitalisation over the past decade.

Andrew White, CEO and Co-Founder of Sapio Research, commented on the findings. “We launched the Sapio Research Finance Pulse to dive deeper into three key areas that matter most to marcom professionals within the financial services sector: consumer attitudes, AI and B2B payments. Financial services are constantly evolving, and our results point to some interesting trends about where the sector is headed in 2024 and beyond.”

“It’s clear that employees working within the finance sector have embraced new technology, and this has certainly been reflected in the innovation we’ve seen in financial services in recent years – from digital banking to cryptocurrency.”

“That said, there is clearly a big education task at hand for financial services providers when it comes to winning over more reluctant buyer categories – particularly those consumers that sit outside the ‘digital native’ category, and B2B buyers, too.”