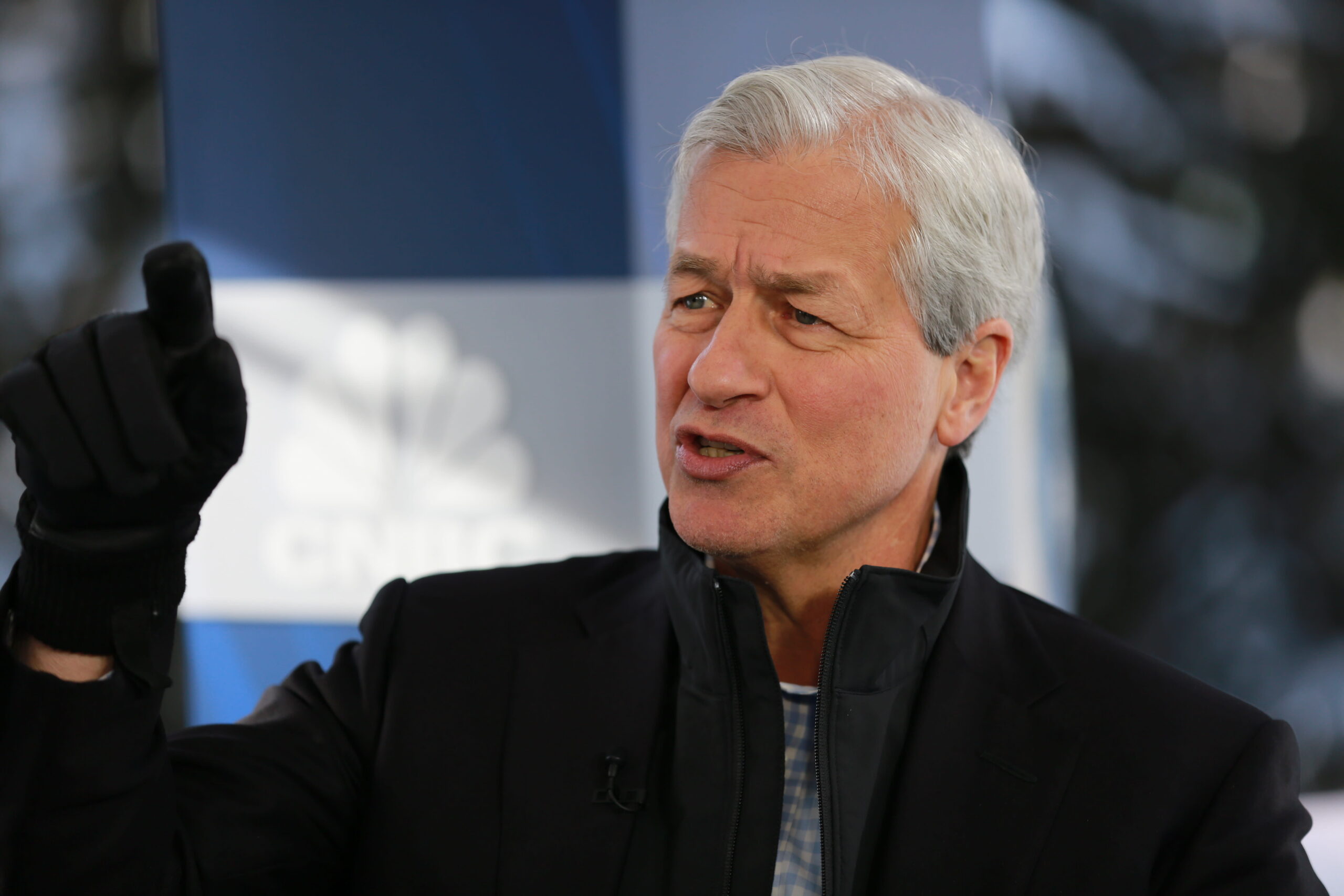

In early Monday trading, JP Morgan’s stock saw a slight increase following the release of CEO Jamie Dimon’s yearly letter to investors. Th letter not only teased plans for leadership transition at the nation’s largest bank but also issued a grave caution about interest rates in the leading global economy.

The anticipation among investors is building for this week’s March inflation data, anticipated to reveal a slight decrease in both headline and core inflation. Federal Reserve officials have emphasized the need for markets to remain patient with potential interest rate reductions as the economy shows signs of strength.

A recent employment report surpassed expectations, reporting 303,000 new jobs in the last month, aligning with predictions from Wall Street regarding wage growth. This coincided with the Atlanta Fed’s GDPNow model adjusting its growth forecast for the current quarter to about 2.5%.

Despite challenges such as last year’s regional bank issues, Dimon noted in his shareholder letter, “the U.S. economy continues to show remarkable resilience with ongoing consumer spending, leading to expectations of a ‘soft landing’ for the economy.” This would entail managing inflation without precipitating a recession.

As the world’s fifth-largest bank, JP Morgan boasts a market capitalization of approximately $572 billion and assets under management worth around $3.2 trillion.

Dimon acknowledged that the current economic expansion is partly driven by significant government deficit spending and previous stimuli. He warned that the costs associated with transitioning to a green economy, revamping supply chains, and increased military expenditures could result in persistent inflation and interest rates exceeding market expectations.

He further observed that U.S. stock valuations remain high historically, even with corporate borrowing costs staying low relative to the prevailing interest rates.

According to LSEG data, the S&P 500’s forward price/earnings ratio stands at about 20.5 times, which, although above the five-year average of roughly 18.9 times, is significantly below the peak of 24.4 times seen in July 1999.

Analysts predict a 5% year-over-year increase in S&P 500 earnings, forecasting a share-weighted total of $457.4 billion, expected to rise to $494.1 billion in the three months ending in June.

Given the overall robust performance of the economy, Dimon suggests the market is factoring in a 70% to 80% probability of a soft landing. However, he personally believes the likelihood of such an outcome is “a lot lower.”

“The die may be cast… Small changes in interest rates might not influence inflation as much as many anticipate in the future,” Dimon stated. “Hence, we are gearing up for a wide spectrum of potential interest rates, from 2% to 8% or even higher,” indicating that any outcome could vary from sustained economic outperformance to a recession coupled with high inflation.